How to Claim Insurance After a Car Accident

Car insurance is a legal requirement that provides protection in case of a collision or injury. It has also become one a significant household expense for many families. According to CTV News, insurance rates have been increasing as companies face higher repair and replacement costs.

At McNally Gervan, many clients ask what steps to take after a crash and how to claim insurance after a car accident without creating additional problems. This guide is designed to answer those questions with practical steps that apply to most insured drivers in Ontario. It also explains what your insurer expects and when legal advice may be useful if your claim is delayed or denied.

How to Make an Insurance Claim After a Car Accident

Report the Accident Immediately

The first step is to contact your insurance company as soon as possible. Most car insurance policies require drivers to report a collision within seven days or at the earliest practical time. When you speak with your insurer, provide details about the accident, including the time, location, and parties involved. Include the licence plate number and driver’s licence of each driver.

Waiting too long to report can cause difficulties later, especially if there are questions about coverage or fault. Keep a record of who you spoke with and when the call was made.

Document the Scene

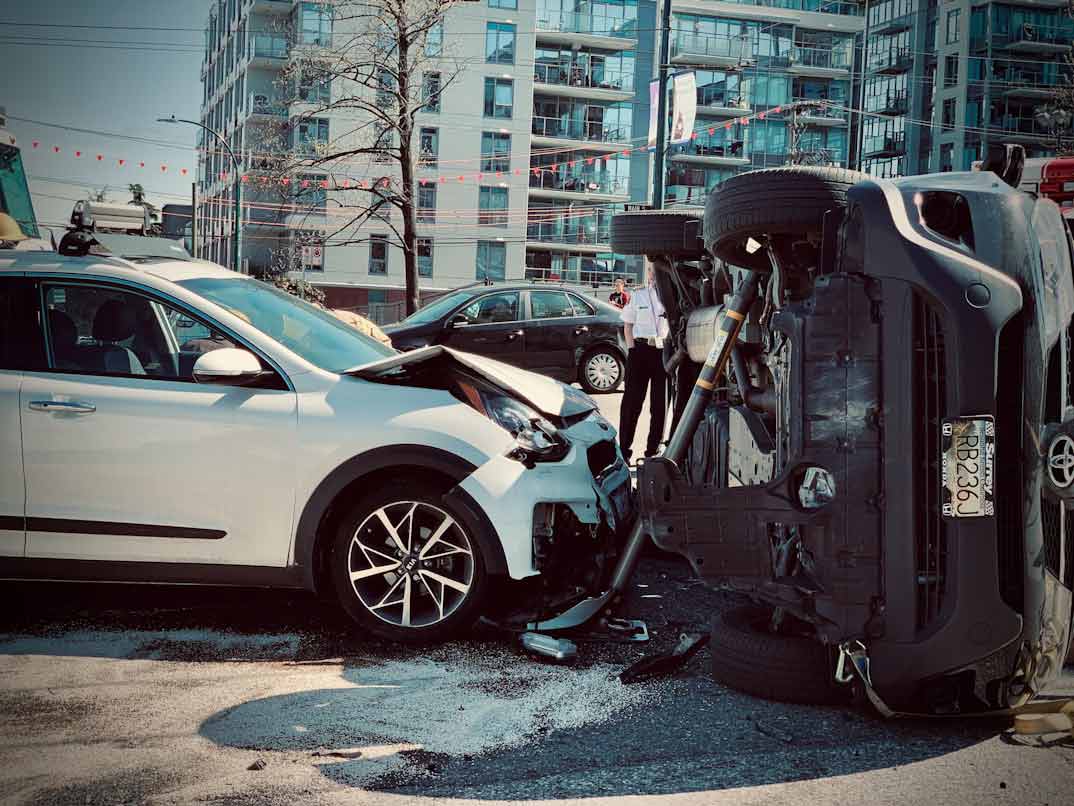

If it is safe, stay at the scene until you have gathered all the information you need. Turn on your hazard lights and use warning triangles if you have them. Take clear photos of the vehicles, the road, and any visible damage. Capture images that show where the damage occurred and the surrounding conditions. Record the plate number of every vehicle involved. Photograph any injuries or property damage nearby.

Keeping an emergency kit in your glove compartment with bottled water, booster cables, and extra batteries can make a stressful situation easier to manage while waiting for assistance.

Exchange Information

Once everyone is safe, exchange information with the other driver. Write down their name, address, phone number, driver’s licence, and insurance details. Do not discuss who might be at fault. Statements made too early can complicate your car insurance claim. If the other driver refuses to share information, record their plate number and contact the police immediately. It is also helpful to gather names and phone numbers of any witnesses who saw what happened during the automobile collision.

Obtain a Police Report

If the accident involves injuries, major damage, or a hit-and-run, it must be reported to the police. Call for assistance and wait for the investigating officer to arrive. Provide accurate information and ask for the officer’s badge number and report number before leaving. A police report serves as an independent record that helps verify how the collision occurred. If a damage sticker is issued, keep it with your documents. This report may be needed later by your insurer or legal representative.

Seek Medical Attention

Visit a healthcare provider as soon as possible after the car accident, even if you believe the injuries are minor. Some conditions take time to appear and can worsen without treatment. Medical records create a timeline that supports a personal injury claim if symptoms develop later. Keep receipts for medical visits, prescriptions, and transportation costs. If your vehicle cannot be driven, call a tow truck and have it taken to an auto shop or a facility approved by your insurer.

File a Claim Form

Once you have notified your insurer, they will send you all the forms required to begin your claim. Complete each section carefully and provide accurate information. Include your policy number, a description of the accident, and details of the damaged vehicle. List any personal contents that were affected and describe the condition prior to the accident. Your insurance company may arrange for an inspection to assess the damage.

If your coverage includes a temporary rental vehicle, you may be able to access one while your car is being evaluated or repaired. Keep copies of all documents you submit.

Cooperate with the Adjuster

An insurance adjuster will contact you to discuss the claim and may request additional information. Their role is to assess the repair cost, determine the actual cash value of the damaged vehicle, and review how your policy coverage applies.

Stay cooperative and provide details as needed. Keep notes of your communication, including dates and phone numbers. If you are not at fault, your insurer may offer direct compensation under your policy, which allows you to recover costs without waiting for the other driver’s insurer to respond.

Review your Auto Insurance Policy

In Ontario, most people purchase rental car insurance that will provide you with a temporary car rental while your vehicle is being repaired or while you are negotiating a settlement with your adjuster. You should read your policy or ask your adjuster how much coverage you have and if there is a maximum amount or time limit to use the coverage. You avoid surprises if you know how much coverage you have before you rent your vehicle.

Review Settlement and Repairs

Before your vehicle is repaired, confirm what the insurance coverage includes. Compare the insurer’s settlement offer to the repair cost provided by the body shop. If the car is beyond repair, the company may compensate you for its actual cash value instead of paying for it to be fixed. Review each document before signing and ask questions about time limits or payment schedules. If you disagree with the insurer’s decision, speak with an Ottawa Car Accident Lawyer to explore your options. Having professional guidance can prevent costly mistakes and protect your right to fair compensation.

How Does Insurance Work When It’s Not Your Fault?

When another driver causes the auto accident, your own insurer can still cover certain expenses through mandatory coverage. Ontario’s direct compensation system allows you to deal with your own provider for repairs and damage to the vehicle. The insurer for the at-fault driver may later reimburse them. This system simplifies the process for most drivers, but disputes can still arise when there is injury, lost income, or uncertainty about who was responsible. Speaking with an experienced Ottawa Personal Injury Lawyer can help clarify these issues and support your claim.

Why Choose McNally Gervan

Filing a car insurance claim can be confusing and time-consuming. At McNally Gervan, our lawyers assist clients through every stage of the process, from accident reporting to settlement negotiations. We understand how insurance companies assess claims and how to respond when coverage is disputed or denied.

Our approach is practical, based on decades of experience handling motor vehicle claims, disability cases, and complex insurance disputes.

If you have questions about your policy coverage, a denied claim, or compensation for injuries, contact our team today. We can help you understand your options and guide you toward the outcome you deserve.

Follow Us